Option Trading Strategies all best strategys using in option treading

Option trading involves various strategies that traders can use to generate profits or hedge risks. Here are some of the most common option trading strategies:

1. Long Call Option: A trader buys a call option with the expectation that the underlying asset's price will rise before the expiration date.

2. Long Put Option: A trader buys a put option with the expectation that the underlying asset's price will fall before the expiration date.

3. Covered Call: A trader holds a long position in an asset and sells a call option on that asset to generate income.

4. Protective Put: A trader holds a long position in an asset and buys a put option to limit potential losses if the asset's price falls.

5. Straddle: A trader buys both a call option and a put option with the same expiration date and strike price, expecting a significant price move in either direction.

6. Strangle: A trader buys a call option and a put option with different strike prices, but the same expiration date, expecting a significant price move in either direction.

7. Butterfly Spread: A trader buys a call option and a put option with the same expiration date and strike price, and sells two options at different strike prices to create a "winged" pattern.

8. Iron Condor: A trader sells both a call option and a put option at different strike prices to generate income, while also buying a call option and a put option with different strike prices to limit potential losses.

These are just a few of the many option trading strategies available. It's important to remember that each strategy has its own advantages and disadvantages, and that no strategy is foolproof. Traders should carefully consider their risk tolerance and market expectations before selecting a strategy.

Explain no 1 strategys

No 1 LONG CALL OPTION :-

A long call option strategy is a bullish strategy where an investor buys a call option contract, giving them the right to buy an underlying asset at a certain price, known as the strike price, within a specified time frame.

Here is an image to help illustrate the long call option strategy:

In this example, the underlying asset is XYZ stock, which is currently trading at $50 per share. The investor believes that the stock price will increase in the near future and decides to execute a long call option strategy.

The investor purchases a call option contract with a strike price of $55 and an expiration date of one month from now. The premium paid for the contract is $2 per share, meaning the investor paid a total of $200 ($2 x 100 shares per contract) for the option.

If the price of XYZ stock increases to $60 per share within the next month, the investor can exercise their option and buy 100 shares of XYZ stock at the strike price of $55 per share. They can then immediately sell the shares on the open market for $60 per share, resulting in a profit of $5 per share or $500 in total ($60 selling price - $55 strike price - $2 premium paid).

However, if the price of XYZ stock does not increase above the strike price of $55 before the expiration date, the investor may choose not to exercise their option, allowing the contract to expire worthless. In this case, the investor would lose the $200 premium paid for the option.

Overall, a long call option strategy can be a high-risk, high-reward investment strategy for investors who believe that the price of an underlying asset will increase in the near future. It is important for investors to fully understand the risks and potential rewards of this strategy before executing it.

No 2 LONG PUT OPTION :-

Long Put Option Strategy

A long put option strategy is a bearish strategy that involves buying put options to profit from a decline in the price of an underlying asset. The strategy involves buying a put option with a strike price that is lower than the current market price of the underlying asset.

Here's an image to help illustrate the long put option strategy:

In this example, let's assume that the underlying asset is a stock that is currently trading at $50 per share. The trader believes that the stock price will decrease in the future and decides to implement a long put option strategy.

The trader purchases a put option with a strike price of $45 and a premium of $2 per share. This means that the trader has the right to sell the stock at $45 per share, regardless of the actual market price.

If the stock price drops below $45, the trader can exercise the option and sell the stock at the higher strike price of $45, making a profit. If the stock price remains above $45, the option will expire worthless and the trader will lose the premium paid for the option.

Overall, a long put option strategy is a way for traders to profit from a decline in the price of an underlying asset, while limiting their potential losses to the premium paid for the option.

No 3 COVERED CALL STRATEGY :-

A covered call strategy is a popular options trading strategy that involves owning shares of a stock and simultaneously selling a call option on those same shares. The goal of this strategy is to generate income from the premium received from selling the call option while also potentially profiting from any increase in the stock's price.

Here is an example of a covered call strategy using the stock of a fictional company, ABC Corp:

Buy 100 shares of ABC Corp at $50 per share for a total cost of $5,000.

Sell a call option on those 100 shares with a strike price of $55 and an expiration date of one month from now for a premium of $2 per share. This generates a total premium of $200 ($2 x 100 shares).

If the stock price stays below the $55 strike price, the call option will expire worthless and the investor keeps the $200 premium. They can then repeat this process by selling another call option on the same shares.

If the stock price rises above the $55 strike price, the call option may be exercised by the option buyer and the investor would be required to sell their shares at $55 per share. However, the investor still keeps the $200 premium, which provides some downside protection.

If the stock price rises significantly and the investor is forced to sell their shares, they still make a profit since they sold their shares at $55 per share, which is higher than the $50 purchase price. Plus, they still keep the $200 premium.

Here is an example of what this strategy might look like visually:

In this example, the blue line represents the profit or loss of owning the 100 shares of ABC Corp. The orange line represents the profit or loss of selling the call option. The green line represents the combined profit or loss of both owning the shares and selling the call option.

As you can see, the covered call strategy can provide a way to generate income while also potentially profiting from any increase in the stock's price. However, there is also some downside risk if the stock price falls significantly. It is important to carefully consider the risks and rewards of this strategy before implementing it in your own portfolio.

No 4 PROTECTIVE PUT STRATEGY :-

The Protective Put strategy is a popular options trading strategy used by investors to protect their portfolio against potential losses. It involves buying a put option on a stock or portfolio, which gives the holder the right to sell the underlying asset at a specified price (the strike price) within a certain period of time.

Here's an example of how the Protective Put strategy works:

Suppose an investor owns 100 shares of a company's stock that is currently trading at $50 per share. The investor is concerned that the stock price might fall in the near future, so they decide to buy a put option with a strike price of $45 and an expiration date of one month from now.

The cost of the put option is $2 per share, or $200 for 100 shares. If the stock price does fall below $45 per share before the expiration date, the investor can exercise the put option and sell the stock at the strike price of $45, limiting their potential losses. However, if the stock price stays above $45 per share, the put option will expire worthless, and the investor will only lose the premium paid for the option.

Here's an image that illustrates the Protective Put strategy:

As you can see in the image, the Protective Put strategy involves buying a put option on the underlying asset, which gives the holder the right to sell the asset at the strike price. If the stock price falls below the strike price, the investor can exercise the put option and sell the asset at the higher strike price, limiting their potential losses. However, if the stock price stays above the strike price, the investor can let the put option expire worthless and only lose the premium paid for the option.

No 5 Straddle strategy explained :-

The straddle strategy is a trading technique that involves buying both a call option and a put option with the same strike price and expiration date. This allows the trader to profit regardless of whether the underlying asset goes up or down in price. Here's an image to help illustrate the strategy:

As you can see in the image, the trader buys both a call option (represented by the blue line) and a put option (represented by the red line) at the same strike price (represented by the green dotted line) and expiration date.

If the underlying asset goes up in price, the call option will increase in value, allowing the trader to profit. If the underlying asset goes down in price, the put option will increase in value, allowing the trader to profit. The profit potential is unlimited if the asset moves significantly in one direction, while the loss potential is limited to the premium paid for both options.

The straddle strategy is often used in volatile markets, where it is difficult to predict the direction of the price movement. By buying both a call and put option, the trader can profit regardless of whether the price goes up or down. However, the strategy can be expensive to implement due to the cost of buying both options.

No 6 STRANGLE STRATEGY :-

The strangle strategy is a popular options trading strategy that involves buying a call option and a put option with the same expiration date, but with different strike prices. The goal of the strangle strategy is to profit from a significant price movement in the underlying asset, either up or down, while limiting the potential loss.

Here is an example of a strangle strategy using images:

Identify the underlying asset and its current price:

Let's say we are interested in trading options on stock XYZ, which is currently trading at $100 per share.

Determine the expiration date and strike prices:

We decide to buy options with a 30-day expiration date, and we choose a call option with a strike price of $105 and a put option with a strike price of $95.

Buy the call option:

We buy a call option with a strike price of $105 for $2 per share, which gives us the right to buy 100 shares of XYZ at $105 per share until the expiration date.

Buy the put option:

We also buy a put option with a strike price of $95 for $1 per share, which gives us the right to sell 100 shares of XYZ at $95 per share until the expiration date.

Calculate the potential profit and loss:

If the price of XYZ stays between $95 and $105 until the expiration date, both the call and put options will expire worthless, and we will lose the premium we paid for them. However, if the price of XYZ moves significantly in either direction, we can profit from the strangle strategy.

If the price of XYZ rises above $107 (which is the sum of the strike price and the premium paid for the call option), we can exercise the call option and buy 100 shares of XYZ at $105 per share, then sell them on the market for a profit. However, if the price of XYZ falls below $94 (which is the difference between the strike price and the premium paid for the put option), we can exercise the put option and sell 100 shares of XYZ at $95 per share, then buy them back on the market for a profit.

Here is an image that shows the potential profit and loss of the strangle strategy:

As you can see, the strangle strategy can be profitable if the price of the underlying asset moves significantly in either direction. However, it is important to remember that options trading involves risks and should only be done by experienced traders who understand the potential risks and rewards.

No 7 Butterfly Spread :-

A butterfly spread is an options trading strategy that involves buying and selling options at three different strike prices, resulting in a limited risk, limited profit position. Let's take a look at a visual representation of a butterfly spread strategy.

First, let's consider a hypothetical example. Suppose that the current stock price of XYZ company is $50, and you believe that the price is going to remain relatively stable over the next few months. You could consider implementing a butterfly spread using options on XYZ stock.

Here's how the butterfly spread would work:

Buy 1 call option at a lower strike price (e.g. $45)

Sell 2 call options at a middle strike price (e.g. $50)

Buy 1 call option at a higher strike price (e.g. $55)

The graph below shows the profit and loss profile of a butterfly spread at expiration, assuming that the stock price remains at $50.

As you can see from the graph, the butterfly spread has a limited risk and limited profit potential. The maximum loss is the amount paid for the options, while the maximum profit is achieved if the stock price is at the middle strike price ($50 in this example) at expiration.

To summarize, a butterfly spread is an options trading strategy that involves buying and selling options at three different strike prices, resulting in a limited risk, limited profit position. It can be used when you expect the underlying stock price to remain relatively stable.

No 8. Iron Condor :-

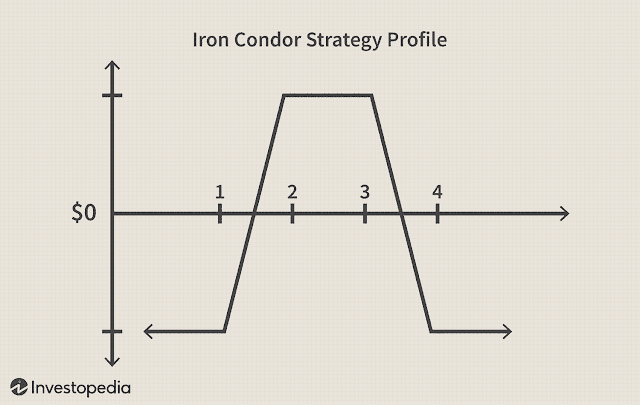

The iron condor is an options trading strategy that involves buying and selling four different options contracts at the same time. The strategy is designed to profit from a stock or index trading within a certain range over a period of time.

To set up an iron condor, you will need to buy one out-of-the-money (OTM) call option, sell one OTM call option with a higher strike price, sell one OTM put option with a lower strike price, and buy one OTM put option with an even lower strike price.

Here is an example of an iron condor strategy using Apple Inc. (AAPL) options:

First, select a time frame and determine your maximum risk and reward. For this example, let's say we're looking to trade options with a 30-day expiration and a maximum risk of $500 and a maximum reward of $250.

Identify the strike prices for the four options contracts. Let's say AAPL is currently trading at $125 per share. We'll use the following strike prices:

Buy one AAPL call option with a strike price of $130 (OTM)

Sell one AAPL call option with a strike price of $135 (OTM)

Sell one AAPL put option with a strike price of $120 (OTM)

Buy one AAPL put option with a strike price of $115 (OTM)

Here's a visual representation of the strike prices:

Calculate the potential profit and loss of the iron condor. Based on the strike prices and premiums for the options contracts, the potential profit and loss for this iron condor would be:

Maximum potential profit: $250 (premium received from selling call and put options)

Maximum potential loss: $500 (the difference between the strike prices of the options contracts minus the premium received)

Place the trades. To execute this iron condor, you would need to place the following trades:

Buy one AAPL call option with a strike price of $130 (OTM) for a premium of $1.50 per share ($150 total).

Sell one AAPL call option with a strike price of $135 (OTM) for a premium of $0.50 per share ($50 total).

Sell one AAPL put option with a strike price of $120 (OTM) for a premium of $1.25 per share ($125 total).

Buy one AAPL put option with a strike price of $115 (OTM) for a premium of $0.25 per share ($25 total).

Here's a visual representation of the iron condor using AAPL options:

Manage the trade. Once the trade is placed, you will need to monitor it and make adjustments as needed. If AAPL stays within the range of $120 and $135, you can let the options expire and keep the premiums received as profit. If AAPL moves outside of this range, you may need to adjust the position or close out the trade to limit your losses.

Remember that options trading involves significant risk and should only be undertaken with a thorough understanding of the strategy and the associated risks. It's always a good idea to consult with a financial advisor before making any investment decisions.

.png)

.png)

Comments

Post a Comment