Investment Strategies for Investor

Investment Strategies for Investor

Introduction:

Investment strategies are techniques or plans that investors use to maximize their returns while minimizing their risks. These strategies are based on various factors such as the investor's financial goals, investment horizon, risk tolerance, and market conditions. In this article, we will discuss some of the most popular investment strategies used by investors.

Value Investing Strategy:

Value investing is a strategy that involves investing in companies that are undervalued by the market. This strategy is based on the principle that the market may undervalue a company's stock for a variety of reasons, such as temporary setbacks or negative publicity. Value investors believe that such undervalued stocks will eventually rise to their true value, providing a good return on investment.

One of the most famous value investors is Warren Buffett, who has built his fortune by investing in undervalued stocks. Buffett looks for companies with strong fundamentals and long-term growth prospects, and he typically holds onto his investments for a long time.

Growth Investing Strategy:

Growth investing is a strategy that involves investing in companies that have high growth potential. This strategy is based on the principle that companies with high growth potential are likely to outperform the market and provide a good return on investment.

Growth investors typically look for companies that are expanding rapidly and have a strong competitive advantage. They may also look for companies that are operating in a rapidly growing market, such as technology or healthcare.

Dividend Investing Strategy:

Dividend investing is a strategy that involves investing in companies that pay high dividends. This strategy is based on the principle that companies that pay high dividends are likely to be financially stable and have a strong cash flow.

Dividend investors typically look for companies with a long history of paying dividends and a high dividend yield. They may also look for companies with a low payout ratio, which indicates that the company has room to increase its dividend payments in the future.

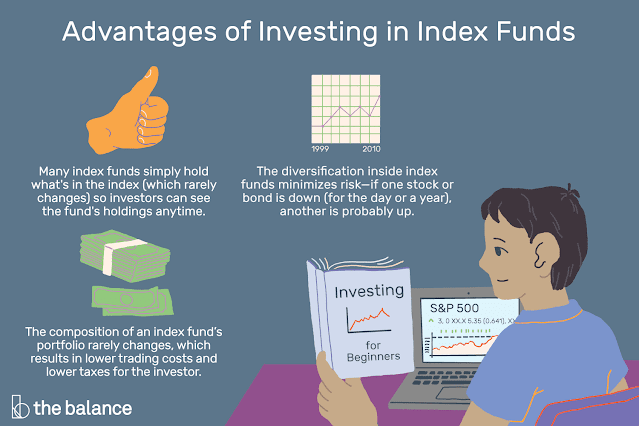

Index Investing Strategy:

Index investing is a strategy that involves investing in a broad market index, such as the S&P 500 or the Dow Jones Industrial Average. This strategy is based on the principle that the market as a whole tends to rise over time, and investing in a broad market index allows investors to capture that growth.

Index investors typically buy shares in an exchange-traded fund (ETF) or a mutual fund that tracks a specific index. These funds typically have low fees and provide broad exposure to the market.

Momentum Investing Strategy:

Momentum investing is a strategy that involves investing in companies that have recently performed well in the market. This strategy is based on the principle that stocks that have recently performed well are likely to continue to perform well in the future.

Momentum investors typically look for stocks that have experienced a significant increase in price or volume in the recent past. They may also look for stocks with a high relative strength index (RSI), which indicates that the stock is overbought and likely to continue to rise.

Contrarian Investing Strategy:

Contrarian investing is a strategy that involves investing in companies that are out of favor with the market. This strategy is based on the principle that the market may overreact to negative news or temporary setbacks, causing the stock price to decline more than is justified.

Contrarian investors typically look for companies that have a long-term growth potential but are currently undervalued by the market due to short-term setbacks or negative publicity.

Buy and Hold Investing Strategy:

Buy and hold investing is a strategy that involves buying a stock and holding onto it for a long time, regardless of short-term market fluctuations. This strategy is based on the principle that the market tends to rise over time, and a long-term investment horizon allows investors to capture that growth.

Buy and hold investors typically look for companies with strong fundamentals and long-term growth prospects. They may also look

.jpeg)

Comments

Post a Comment